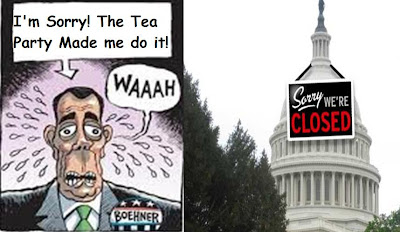

It is extremely likely that we are heading towards a market selloff in the next couple of weeks, due to the extreme likelihood of an upcoming government shutdown. In a flashback to the 1990's, we are probably sailing directly towards a government shutdown, with two sides locked in combat. John Boehner, the Republican Speaker of the House of Representatives, is steering the ship of state directly toward a conflict with the Democratic Senate and President, and at the moment I unfortunately think we do not have enough time left to avoid it, before the March 4th deadline.

In a recent interview Speaker Boehner said that he would not negotiate a temporary spending bill to keep the government running, opting instead for a direct confrontation. This author is not taking sides, just pointing out that since the two sides are so far apart, and since the deadline is March 4, the chances of a compromise by then are very slim. I hope that I am wrong, but am recommending to readers that they prepare for the possibility of a shutdown.

This is important to individual investors, because a government shutdown will more than likely spook the global markets, and trigger a selloff in the global financial markets. In general, markets abhor uncertainty, and a shutdown is a very uncertain process. The unknowns include, how long it will last, what the results will be, and the lasting effects on a still fragile economy.

0 comments:

Post a Comment